As residents and visitors to the Mile High City may have noticed, there’s significant multifamily residential construction underway in the Downtown Denver area. Back in April, I observed that Denver was on the cusp of another Downtown housing boom and, indeed, there is no longer any doubt that Denver is experiencing a major multifamily housing expansion in its urban core.

Downtown Denver’s construction boom from the 2000s never really came to an end with the 2008-2010 recession; it just shifted gears. Pre-recession, Downtown Denver experienced a diverse mix of development: numerous condominium and apartment projects and various cultural, office, and hotel developments. When the recession hit, Denver had (as it usually does) a queue of civic projects ready to begin construction (Denver Union Station, Ralph Carr Colorado Judicial Center, History Colorado Center, Clyfford Still Museum, Denver bond projects), which kept Downtown’s construction scene lively despite the private-sector’s woes. Now, with those civic projects wrapping up, the improving economy and apparent demographic shifts are fueling the next wave of Downtown Denver development: for-rent multifamily residential.

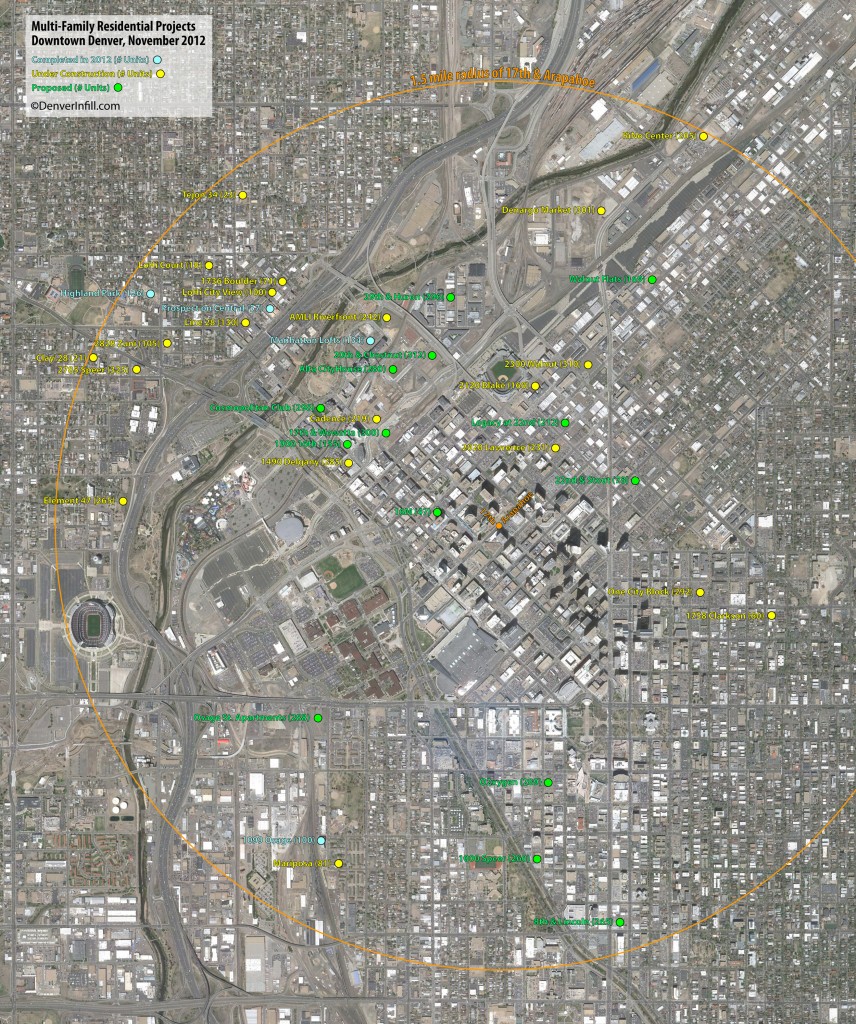

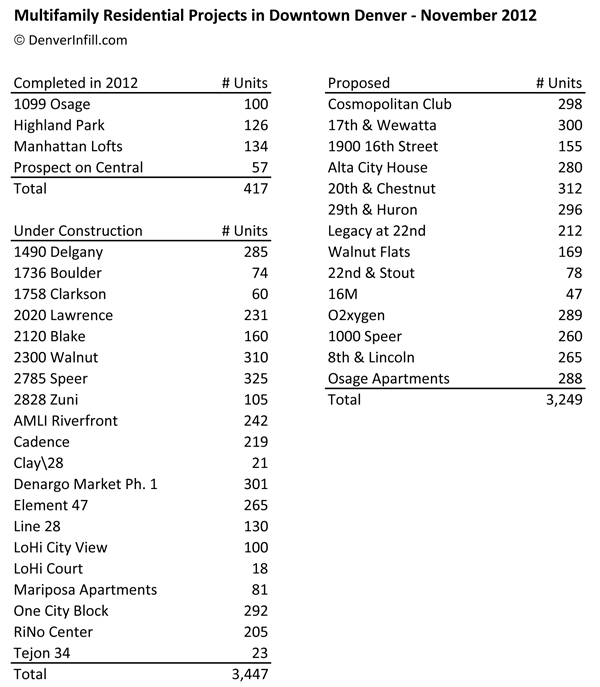

Let’s put Downtown Denver’s present housing boom in some recent historical context: There were approximately 10,500 residential units (both for-sale and for-rent—but mostly for-sale) that were built during the 2000-2009 decade within Denver’s center city districts. Downtown Denver’s current housing boom, which gained momentum in the second half of 2011 and really took off in 2012, has over 3,800 units currently under construction/recently completed within just a 1.5-mile radius of Downtown Denver. This represents nearly 40% the total number of housing units completed during the entire 2000s decade, in just 20% the time. Let’s take a look at Downtown Denver’s current housing boom (click to embiggen or, if you prefer, click here to download a PDF of this image):

Please note that there are a handful of projects on this map that I haven’t yet gotten around to covering on this blog (stay tuned… working on it!); a few projects that you may have heard rumors about but are not on the map because I consider them at the moment to be too uncertain/speculative; a few projects not on the map due to the small number of units; and perhaps a few projects not on the map that I just simply missed. Nevertheless, this gives you a pretty good idea of what’s going on in the Downtown Denver area. Also, please remember that this map covers only multifamily residential projects, so office and hotel developments are not included. Anyway, let’s break this down by project status:

Next, there are the 3,200-plus residential units currently proposed for the Downtown Denver area. Of those, I believe about half them will begin construction within the next six months. If so, that means Denver will add approximately 5,000 residential units to its Downtown area from mid-2012 to mid-2014, or roughly half its total from the entire 2000s decade.

Is that too many residential units in too short of a time period for Downtown Denver?

The Denver metro apartment vacancy rate is currently at a 12-year low. Virtually no new multifamily residential units were added to the market during the economic downturn. Denver led the nation during the recession as the most popular relocation destination for young adults. And, there’s substantial evidence of a growing trend—a cultural shift, actually—for people wanting to live and work in urban areas. So, to answer the question I posed above: Is that too many residential units in too short of a time period? No, I do not think we are currently over-building multifamily residential in Downtown Denver. However, if developers were to continue to propose new for-rent multifamily residential projects in 2013 at the same rate we’ve seen them propose new projects during 2012 then, yes, I believe it would behoove Denver to slow things down a bit, absent some other market factor (i.e. a major spike in job growth) that would justify continuing apartment development at such a vigorous rate.

Fortunately, we’re already seeing a reduction in the frequency of new project announcements. Most of the developments listed under the “Proposed” section in the table above have been around since earlier this year, and not many new projects have been announced within the past month or two. This is a good thing, and hopefully a sign that developers are sensing that we’re at a “wait-and-see” moment in the market.

Another factor to consider is the re-emergence of Downtown Denver’s condominium market. About 99% of the units itemized in the table above are for-rent units. However, with home sales in the metro Denver area improving at a dramatic rate, it is plausible to envision a time in the not-too-distant future when developers will restart Downtown Denver’s condo market. They will probably begin with smaller, lower-risk projects (row houses and boutique flats), but the timing may work out just right: as the Downtown Denver rental market softens, the Downtown Denver condo market takes off.

Regardless of what the market may be like during the rest of the 2010s decade, the current investments taking place in Downtown Denver as a major, mainstream residential market is profound, and is likely to propel Downtown Denver over the tipping-point of becoming America’s next “don’t-need-a-car, live-work-play-shop” market in its own right.

Thanks for the article and the graphic. Clearly, the north side of Denver is seeing twice the new growth as the southern end. Two questions; is your choice of the geographical center of Denver definitive? Also, I don’t think I’ve seen an infill article on the proposal at 29th & Huron. Do you have one planned? Thanks for the great work!

I will be covering the 29th and Huron project. I am just waiting on some renderings from the presentation I went to.

The choice of 17th & Arapahoe just seemed like a good central spot that also fit the data well on the north side.

All this new density is great, but is Denver’s transportation infrastructure keeping up? FasTracks mostly serves the suburbs and with the circulator being scaled back I am afraid development is going to be hindered by parking and congestion woes. Since a streetcar is likely decades away, Denver needs to get creative regarding its bus and cycling network. How about new developments contributing towards a transit fund in exchange for lower parking minimums? How about extending the mall shuttle across the river into lower highlands? That would certainly relieve some of the parking issues in that neighborhood.

Just curious, what makes you think that a streetcar system is still decades away? With the discussion of turning the central corridor light-rail along Welton/Downing into a streetcar as well as the ridership studies that have been done on the Colfax corridor I’ve always assumed that a streetcar network is really just around the corner.

I think the City of Denver must be figuring out, much like the rest of us have, that the light-rail network has really materialized as more of a commuter-based system and hasn’t worked out as an effective inner-city transit network as the planners may have first thought 20 years ago. This of course makes sense considering that the suburbs are footing a large portion of the bill for the light-rail and have no political motivation to help Denver create a local transit system. I think this is evidenced by the fact that the original central corridor has been downplayed in favor of Union Station in the recent system expansion, and by the fact that they are talking about severing the Welton corridor entirely by turning it into a streetcar. Combine this with the new circulator being significantly scaled back and I would be VERY surprised if the city isn’t already brainstorming a way to fund a more robust local transit network.

I would agree. It would not surprise me if both the East Colfax streetcar and the Welton streetcar conversion are both up and running by 2020.

I think Denver’s transportation infrastructure will eventually build itself into a corner especially with the development concentration on the north end of the city. There is temporary relief coming with the three I-25 projects, but there needs to be a development push on the Brighton Blvd corridor as well as in Golden Triangle. I do agree the viability of downtown office concentration will be squeezed by congestion, particularly automobiles. Light rail and bus are options for only a few.

It also occurs to me while watching the Union Station development that one thing the planners may have underestimated is the auto traffic for picking up or dropping off passengers for the DIA train – East Line. It seems that with as many as 6-8 trains per hour with as many as 250 passengers per train at Union Station, that’s a lot of potential cars picking up and dropping off. I don’t see anything to facilitate that activity, fleeting though it may be. Many local travelers will use the train to save on parking at the airport. Again, light rail only helps a relatively small percentage in this regard.

I belive there’s a drop-off zone in front of the historic station on Wynkoop and another one along Wewatta next to the Wewatta Pavilion. If people are truly just dwelling long enough for people to get out of the car, grab their bags from the trunk, and off they go, then I think there should be enough turnover to keep things flowing… kind of like the passenger drop-off zones at DIA.

There is an apartment building going up at 8th and Emerson and 6th and Logan…..awesome graphic!

Very good article, Ken. The upcoming population boom will do more to make Denver appear attractive to future residents than any particular new building in comparison. More residents walking and living area creates a safer and more energetic presence. Think of the Rockies playing at a sold out stadium versus half full. It’s just more impact full, especially economically. Lets say the average resident spends $10k/yr locally in food, entertainment, services, and retail. 5,000 people will add $5M to the local economy, which in turn generates more than a half million dollars in tax revenue, from sales tax and property tax, etc.. This is money that Denver definetely could use to fill budget gaps.

If you post a future article related to Denver budgets, I’d be interested to read it.

Just fyi, the project is 1756 Clarkson, not 1758 as in the article.

Searching previous posts it looks like Alta City House & 20th & Chestnut should have started construction. Ken, do you know if they will start anytime soon?

It looks like there’s a construction fence up around Alta so that may be getting underway soon. Regarding 20th & Chestnut, there was a delay but not because the project is in doubt. I believe there will be a very positive announcement on that soon.

Woot, that is really good to hear Ken. I did see the construction fence up at Alta and there seemed to be an earth mover on site, but wasn’t sure if that was just storage for Cadence or Union Station. Thanks for posting this update!!

There are projects like everywhere in this town. It’s cray cray!

The Rockies were 13th in attendance out of 30 teams despite being one of the worst teams. Just putting a competitive team on the field will help to fill that stadium, since clearly people in Colorado like baseball and going to Lodo for a game.

My wife and I have lived in Lohi for 2 years since buying a condo. First off, there is ample parking here. All you have to do is go several blocks away from the Lola, Linger, Little Man, etc. corner to find it. Also, it is 1.3 miles from 32nd and Tejon to Larimer Square and a very enjoyable walk over the Highland Bridge and the Millenium Bridge. We don’t need the mall shuttle or really anything for that matter to span that short distance. It’s Colorado, just get out and walk or bike!

“Just putting a competitive team on the field will help to fill that stadium…” Good luck with that! 🙂

The population infusion is spectacular and was envisioned over a decade ago by Jennifer Moulton. Her push for downtown living near the center city is finally coming to fruition after nearly two decades of development. We also saw the value of this when the DNC came to town and instantaneously added 50,000 people; the streets were buzzing and full of life! Although the market focus is currently on the attracting the low hanging fruit – the millennials – and their desire to live in more urban environments, the next forward-looking opportunity would be to promote multi-generational living including seniors and families. Great cities support broad diversity and embrace multi-generational living in the center city by creating amenities to attract and sustain diverse populations. Rivers, parks, public space and schools are all critical to this endeavor; just look at Barcelona for inspiration.

Even closer to home, Portland and Vancouver are also great examples of cities with multigenerational residents in center cities. Denver definitely seems to be heading in that direction.

Well said, I couldn’t agree more! I think that finding a reasonable, affordable way to bring families back into the city is one of the biggest challenges facing urbanists in the coming decades. But being the pragmatist that I am, I certainly cannot fault developers for going after “low-hanging fruit,” especially if it successfully reactivates the city!!

Ken, have you heard anything about the age-restricted apartment building that is supposed to go up on the southeast corner of 15th and Little Raven, next to the Promenade Lofts? They removed the parking gate and have a construction trailer but have not seen any activity for quite a while now. I think this project will definitely help get a diverse age demographic downtown.

I believe that urban living should appeal to a wide range of people. Downtown living is more appealing to younger folks because many do not have kids and want the access to bars and nightlife. However, as they get older, i think the feeling is that they need to move out of downtown so they can have safe, outdoor places for kids and yards for dogs, etc. In order to overcome this, I would like to see downtown Denver invest more in public parks and green space mixed in with the buildings, especially around residential areas.. Also more childcare facilities that parent’s can feel safe leaving their kids at.

Along with, I recently talked to a young family that moved to the Highlands area about their thoughts on schooling for their young daughter. Being someone who grew up in the DPS school system, I wanted to know what their thoughts are on sending their daughter to their neighborhood schools. Personally, I had a wonderful experience in DPS and feel most of us ended up “better off” than a lot of my friends in suburban schools. I’ll save that discussion for another day. The young Highland family said they feel that neighborhood schooling through elementary school is great but there is a serious drop off at middle school and high school. The general feeling is that as more families move in to the neighborhood with young kids and a focus on education, those kids would slowly start to filter into the middle and high schools and that eventually, those schools will gain a better reputation by the time their young daughter gets to that age. I understand this is gentrification and the issues that go with it. They said people are not moving to Denver because of the schools but they are no longer moving out because of the schools. I think that as people return to living in the city, the schools will get better and loose the bad reputation that has kept so many families out. Hopefully, this will make downtown living even more attractive to a wide range of people.

What’s the news regarding Dana Crawford and her business partners buying several properties along Brighton Blvd, including the Horizon Glass manufacturing building?

It appears that stretch of road will be substantially different in a few year’s time as developments start sprouting up along that road. Improving the riverfront access will do wonders in making that section of town.

This boom is indeed very exciting. Even more exciting to me is the overall urban-living trend and Denver’s appeal to young educated people, which suggests this boom could be just the beginning.

There really is a buzz about Denver and it just *feels* like the town is on the cusp of something big. I don’t know what exactly. The next Silicon Valley-esque industry mecca? Some music/arts scene blowing up? I have no idea; it’s just a feeling I get.

Ken, you’re a good writer.

Thanks!

Any chance of seeing one of these done for Commercial/Cultural/Educational infill projects that are on the boards? I know their aren’t as many but it would be interesting to see how these projects stack up against residential projects.

This is a great update, thanks Ken. This felt a little bit like the circa-2004 version of Denver Infill all wrapped up in a single blog post.

I have not heard anything new on the Mizpah Arch.Has there been any progress on this?

Ken, could you comment at all on plans for small retail at the ground level on these bigger developments? I understand that an additional half million people living downtown will help with the critical mass you’ve talked about, but I would argue that small scale retail along the ground level of these developments gives people a reason to walk around, and diversifies the streetscape/street wall. It also gives people one less reason to get in their car (or get on a streetcar, for that matter), if something they have to leave the house for is within walking distance. If I had one criticism of the great building boom of downtown Denver, it would be lack of this sort of retail experience, which makes older LoDo, and other historic commercial blocks throughout the city so attractive.