Similar to our series of updates on Downtown Denver’s multifamily residential projects, let’s take a summary look at Downtown Denver’s new office projects.

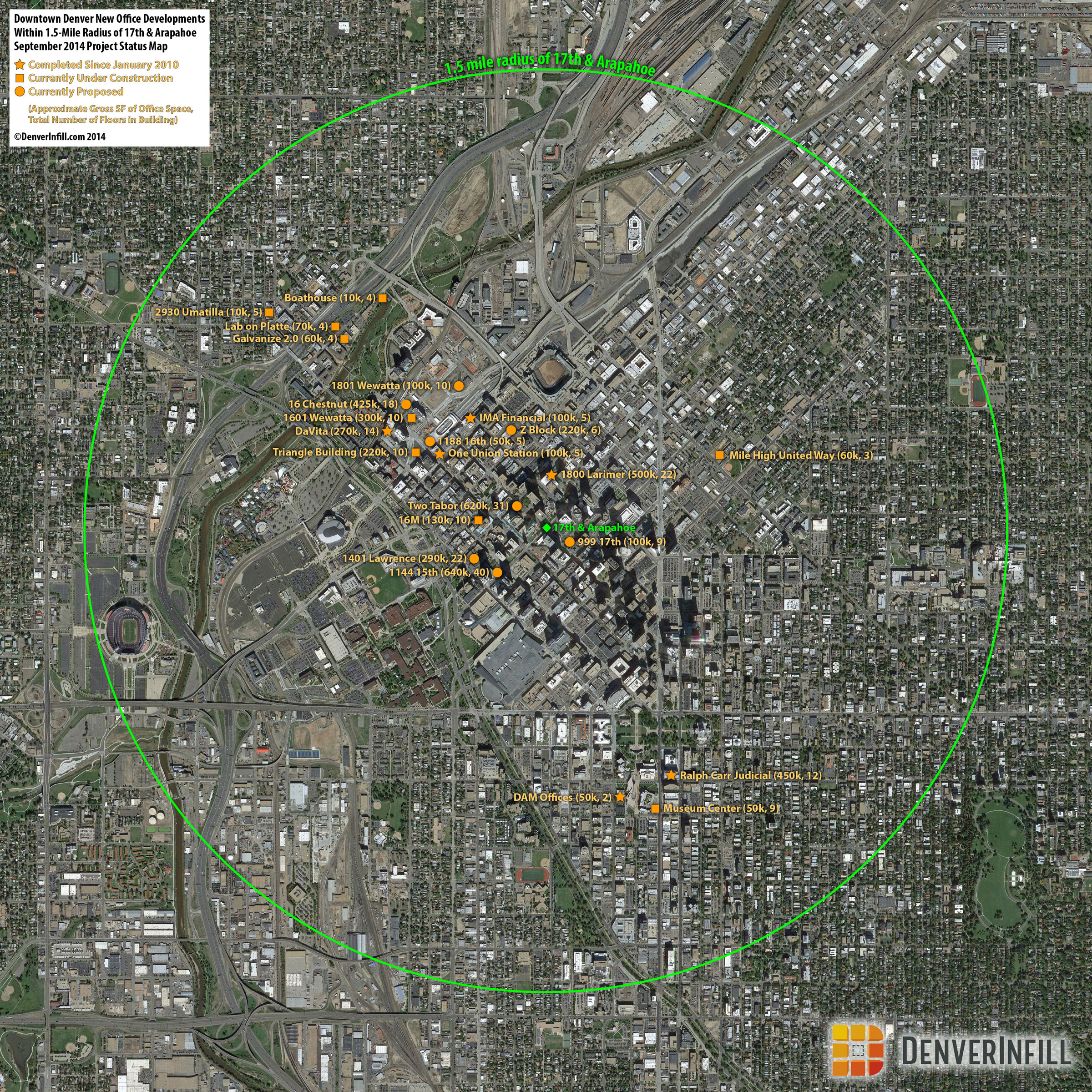

Projects included in the map and table below are those that are new construction projects with an office component that have been completed, are under construction, or proposed since January 2010 and located within a 1.5-mile radius of a geographic central point (17th and Arapahoe) in Downtown Denver. Projects outside of the green circle but within the extent of the Google Earth aerial image are not shown. A project is included in the Proposed category if a development application has been filed with the city or if the project has otherwise been made public to some degree. The gross office square footage figures listed are approximate and the number of floors listed is for the entire building, not just the office portion in the case of mixed-use projects.

Here’s our Downtown Denver New Office Projects map for September 2014. Click to embiggen:

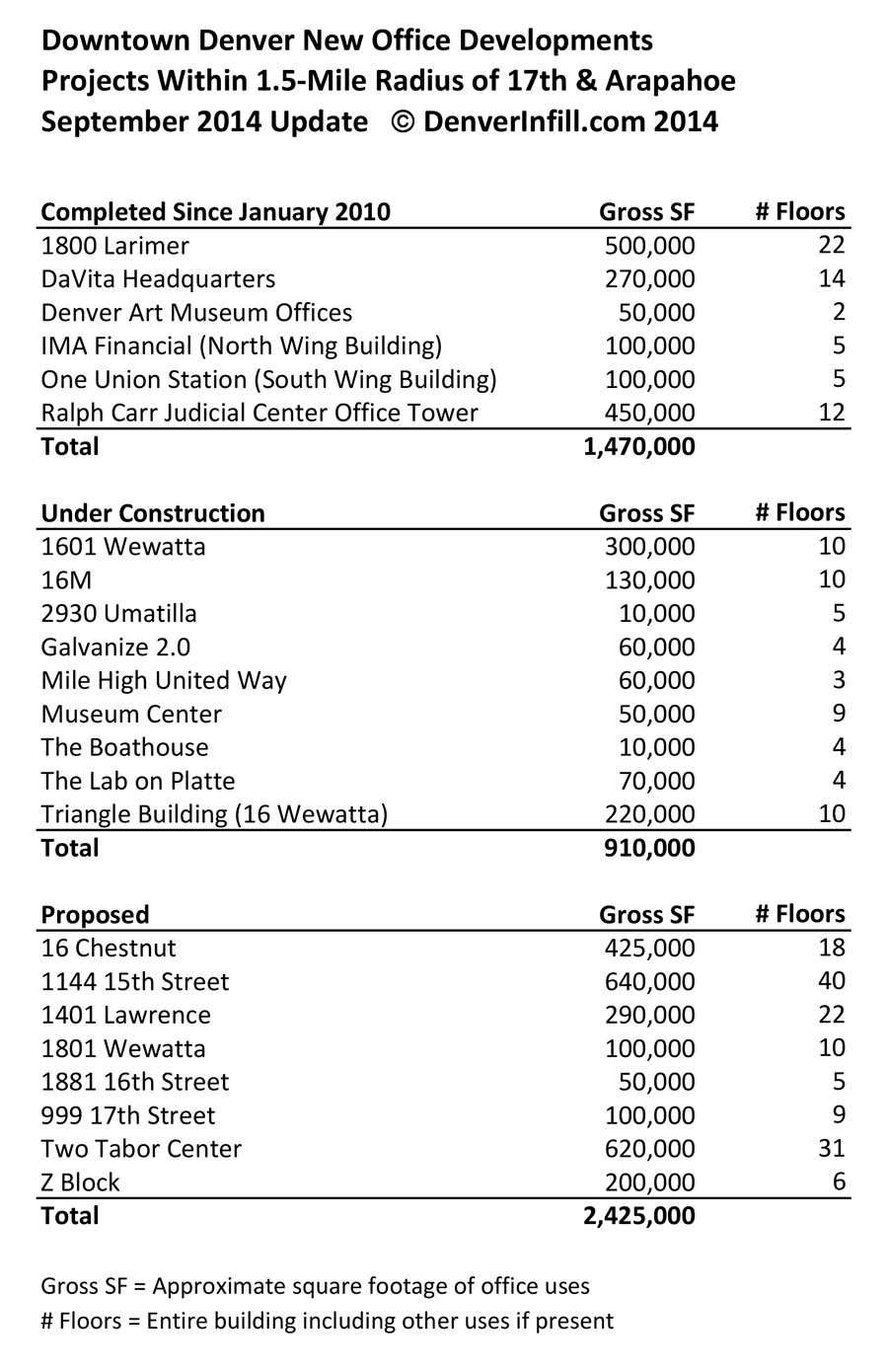

Here is a summary table to accompany the map. Click here to download both the map and table in PDF format.

Nearly 1.5 square feet of office space has been developed in Downtown Denver since the start of the decade, and almost another one million square feet is currently under development. The Proposed projects that are most likely to break ground next are 1881 16th Street and 1401 Lawrence (probably before the end of the year) and 1144 15th Street is reportedly scheduled to start in May 2015. At the end of the 2nd Quarter 2014, the Central Business District office vacancy rate was a little over 12%.

Edit 2014-09-14, 9:25 PM: Updated exhibits with corrected square footage information.

Thanks for another great update, Ken! Looks like — if all the proposed projects break ground by 2015 — that Downtown is currently adding nearly a million square feet per year. So how does that compare to peak periods of office construction, especially in the 70’s and early 80’s?

Office space absorption is a pretty good indicator of job growth, along with Downtown housing absorption, in rentals and condos. So how does the over-all growth picture look?

Glad to see this as it looks like office building construction will become more prominent.

Taking a good look at the “completed” list I realized that all those projects have (predominantly) one tenant.

I also happen to notice that the 1.5 mile radius residential list caught the attention of Larry Olmsted: http://www.forbes.com/sites/larryolmsted/2012/08/29/great-urban-weekend-escapes-denver-co/

Great info as always Ken.

Do you expect Skyhouse and/or Confluence Park tower to begin in 2014? Also, what is the deal with 16 Chestnut? That seems to be taking its sweet time getting off the ground.

16 Chestnut will be developed by the same developer doing the Triangle building, so I believe they will wait until Triangle is finished unless they happen to land an anchor tenant for 16 Chestnut in the meantime.

SkyHouse may get off the ground in 2014, I hope. Hard to say about Confluence. Fingers crossed.

Mile High United Way had their grand opening last night. Any update on what will be happening with their old space?

From the link below, it would seem that the old building will be razed to make use for a new residential and multi-use building.

http://www.bizjournals.com/denver/blog/real_deals/2013/10/new-mixed-use-development-planned-for.html

Is The Spire ever going to fully complete the balconies on the east side of the building along with the narrow strip in the middle to match the other side? It looks like they abruptly stopped that portion of the building during construction and deemed it complete.

Great product and new way to look at commercial office marketplace, Ken.

I like to follow this market due to my interest in large down town development and experience having managed a large development and lease in downtown. The current vacancy rate in downtown for Class A space is still double digit (13-15%) and lease rates are still pretty low (say $25 per square foot average). The disappointing thing about published vacancy rates is the lack of publishing a denominator (15% of what) – or the total square footage that exists in the marketplace (nor is there enough information to back into that number). Most of the new projects on your list individually and collectively have very little impact on the total square footage inventory in downtown. They are somewhat boutique in size and location, and will probably command the high end of lease rates ($30-35 per square foot). The true high-rise developers will not start development (in my experience) until the vacancy rate is under 10% and the prospect for lease rates is higher. I think these smaller projects are still very important and I hope that all are completed. They help ‘seal the edges’ and will increase the probability that true high rise like Tabor 2 and other infill potential will be developed. A better economy will help also. I think there are other factors that are finally settling out the market: 1) the consolidation of government office space out of leased space into owned space (the state office tower and redo of the federal office building near the courthouses), and 2) the consolidation of office space into their own campus by Charles Schwab campus and similar projects. It will take a while to absorb these newer vacancies. I also notice the inventory has been remixed a bit where some formerly Class A buildings become Class B depending on their age and where they are in remodeling and maintenance plans. It seems office space development has long cycle times and many influencing factors. Denver downtown is still in excellent condition and primed for the future if the economy takes off.

Great insights, Dan. Across the country for the past couple decades, only a few high-rise office towers have gone up, reflecting a major shift in the workplace, to home-based office work, and “back office” functions in lower-cost office parks and industrial parks, usually in the suburbs. The Denver Tech Center effect, competing with Downtown.

In LA, a 77-story skyscraper under construction will be principally a hotel, and partly office building. In Century City, the home of high-powered law firms and talent agencies, several office towers are “on hold,” awaiting more certainty about the legally-contested route of the “Subway to the Sea” — but mostly, as you point out — a stronger economy.

Given the general softness of the office market, looks like most of the big buildings we’ll see going up in Denver will continue to be apartments, then condos — again, as the economy improves.

Agree with your comments Jim, except that my research shows that suburban and corridor office parks are not lower lease cost – in fact they are higher than downtown. Also interesting to note that residential development inside both downtown and suburban work centers is a successful survival strategy for these areas. Many other cities still have clear separation of these two functions which leaves the work center a ghost town after work hours. Back in the days of ‘urban renewal’ buildings were knocked down with the unwarranted expectation that ‘they will come’. Downtown Denver was abhorrent, especially after hours. It took decades and an oil and gas boom to recover. Denver downtown is now vibrant and desirable and all the office parks in the metro area are following suit developing residential inside the parks, thereby enhancing their character and life span, in my opinion.

A better economy will also help, but we may have to permanently adjust to this softer economy given that the manufacturing sector may be lost. Even so, I think the inclusion of dense residential in urban areas ensures their survival and vibrance. It is just another way of living. Great examples are NYC, Chicago, London, SF. Cities at risk are LA, Houston, Atlanta, Dallas, Detroit (they aren’t building high rise offices in those cities either, even though in Texas their economy is just fine). The office high rise is also at risk due to the issue of competitive efficiency you mention. Paying $35 (Denver) to $150 (NYC, Chicago) has very little value add to the customer or stock holder. That said, I would really like to see Denver add half a dozen 60-80 story, visually appealing office buildings inside of downtown. To me that would complete the picture.

Dan, you have a lot of cred, due to your experience in office leasing. I strongly agree with you about Atlanta, Houston and Dallas, where the work-day world is very one-dimensional, and the streets at night are vacant and forbidding –because nobody lives there, or wants to be there after dark. All I know about Detroit is that it’s a failed city.

Denver, by contrast, is alive and interesting. A fun place to work and live. And getting better with each new housing project. A King Soopers in Union Station opening soon is especially promising for street life. LoDo is taking on an urban village feel. Downtown just keeps getting more attractive as a place to be, now that rail becomes a real option for more and more people.

Somewhat independent of the Back to the City movement of Millenials, the office market seems to move at its own speed, driven — as you say — by vacancy rates, leasing rates, and the thing we call the economy. Agree with you, Denver needs some big monumental skyscrapers, to fill in the cityscape.

And as for downtown LA, where a lot of apartments are being added, the scene is improving, but street life after dark is still considered pretty dangerous and the sidewalk scene is dirty and scary. As a result, more and more elevated walkways “protect” apartment dwellers from the streets, below.

I still think of Hollywood as the “heart of town,” where several new high-rise apartment buildings are rising along Sunset, but the urban mix on the sidewalks is very spooky, as evening turns into late night. The trash, graffiti and menacing faces contrast starkly with the clean, friendly and much safer scene you find on most Denver streets, even in the late hours. People who complain about the homeless around Arapahoe Square have no idea how much worse so many other cities are, compared to Denver, which is an urban jewel.

Dan… With respect to total downtown office space as of Sept. 2013 there was 27.1 million sq. ft. with 675,000 sq. ft. under construction. I got that HERE: http://www.downtowndenver.com/wp-content/uploads/2013/09/StateofDowntownDenver_Web.pdf (Hint: Make Google your friend)

From what I gather there has been little high-rise construction (over 50 stories) since the 1980’s excepting SF, Chicago, NYC and Miami. I wouldn’t worry too much about Atlanta, Dallas or Houston. Atlanta did experience over-building prior to the recession, high vacancy and low rents but that has changed rapidly in the last 18 months. Hines is proposing like 2 million sq. ft. development and there’s a bunch of other proposals popping up like spring flowers. Dallas has their Mid-town development which is Chery Creek quality and has been HOT. Houston is On Fire from all of the energy investment.

With respect to Denver as Ken lists above, there’s been 1.5 million sq. ft since Jan. 2010 with nearly a million under construction and 2.5 million proposed. Admittedly the energy moved to LoDo and now to Union Station but Central downtown is back on the drawing board.

Good find TakeFive. I thought the total space inventory would be higher, and also the total downtown workers be higher (only 115,000). These are good baseline facts to know. It makes the vacancy rates much more meaningful. 10% of 27 million is 3-4 very tall high rises. I will watch the absorption rate closely over the next year or so.