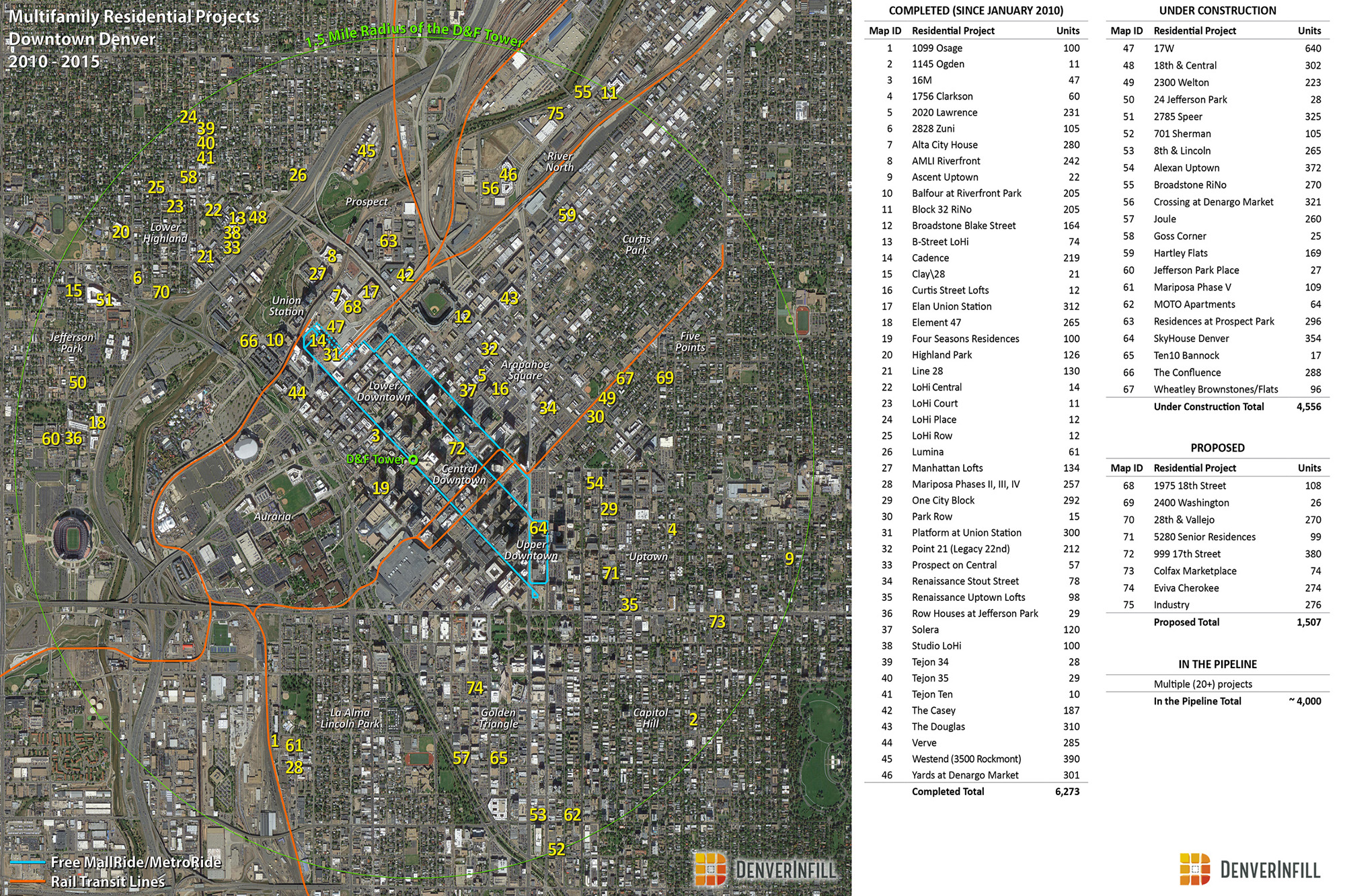

It has been eleven months since we last tallied the number of new multifamily residential units in the Downtown Denver area, so let’s do an update on that today.

A total of 6,273 multifamily residential units have been completed within a 1.5 mile radius of the iconic D&F Tower since January 2010. The historic tower’s location at 16th and Arapahoe serves as a good geographic central point to Downtown Denver.

Another 4,556 units are currently under construction.

Assuming most of the units under construction are completed within the next year and a half, 10,829 residential units will have been added to the Downtown residential market from 2010-2016, with the vast majority of those (10,609) from 2012-2016. This represents an average of approximately 1,550 units per year (2010-2016) or 2,121 units per year (2012-2016). About 96% of the total are rental units.

There are 1,507 proposed units if you count only those proposed developments that we have already profiled here on DenverInfill. However, there are many additional developments “in the pipeline” that we have not yet profiled. These projects range from those that stand a good chance of happening (but, for various reasons, we haven’t yet covered on the blog) to those that are at the rumor stage and/or are very early in the development process—and everything in between. Based on our assessment, these “in the pipeline” projects total approximately 4,000 units.

Click on the image below to view in full size our June 2015 Downtown Denver Multifamily Residential Projects map and table. Use this link to view/download a high-resolution PDF version (6 MB) formatted for printing at 11″ x 17″.

People ask me all the time if I think we are overbuilding housing in the Downtown area. Let’s crunch a few numbers to think about that question.

The Colorado State Demographer’s forecast for Denver’s 2015 population is 676,282, or an increase of about 72,000 people since 2010. The State Demographer’s data also show that 64% of Denver’s recent population growth has been as a result of net migration (36% from natural increases), and that the people migrating here are overwhelmingly in the 20-34 age range. Applying the 64% net migration rate to the 72,000 total 2010-2015 population increase means that about 46,000 additional people moved to the city of Denver (presumably needing housing) during roughly the same time period covered in our Multifamily Residential Projects exhibit above. What percentage of those 46,000 newcomers want to (or can afford to) live in the Downtown area?

Assuming an average of 1.5 persons per household (typical for Downtown-area neighborhoods from the 2010 Census), the 6,273 multifamily residential units completed in the Downtown area since 2010 represent housing supply for approximately 9,400 people. This 9,400 figure is 20% of the 46,000 number discussed above. Does it seem reasonable that Downtown might capture 20% (1 in 5) of these 46,000 new Denver residents? If yes, then we’re not overbuilding. If no, then maybe we are.

Of course, it’s not really that simple. There are dozens of other factors involved and my number crunching above is really just a quick, superficial stab at putting these Downtown housing numbers into perspective from just one angle. But the anecdotal evidence seems to suggest that all these new Downtown housing units are being absorbed at a sufficient pace to not (yet) cause panic among multifamily residential developers and market analysts.

What these new multifamily residential projects are doing is mending the holes in the urban fabric caused by accommodating the private automobile in an inappropriate, thoughtless way. They are improving the pedestrian environment by adding new sidewalks and streetscaping, ground-floor activity, and eyes on the street. They are putting more people within walking and biking distance of transit, work, school, and recreation. They are bringing us closer to having a critical mass of Downtown residents necessary for more and better retail options. They are making Downtown Denver a better place.

How about this: Is the price of rent going up? If yes, then supply hasn’t met demand. Since rent has gone up some 30% in the last few years, how about we increase the number of apartments by 30%?

I like the sound of that, but will it happen? Probably not. I think one thing that we should really be pushing for is for the Construction Defects law to be reformed. The numbers don’t lie, that law is directly responsible for the lack of new condos all over Colorado. If we give people the option of buying then we should see rent prices decrease…

I agree, John. The construction defect law needs to be looked at again. I’d like to see more condos for sale.

It doesn’t exactly work like that. All of these apartments are brand new and can justify higher prices, this allows older places to raise their prices as long as they’re lower than the new ones.

Hi Mckillio,

I’m not going to pretend to be an authority on all of the ends and outs of why the rent in Denver has increased so much. I don’t think the Construction Defects law is the only reason for rents increasing so much, but I think it is apart of it…. My basis for that logic is simple supply and demand. If you take people out of the rental market you are decreasing demand for apartments and therefore rent should go down. Again, I know there are other variables, but I just can’t ignore the effects of the Construction Defects law.

Even if a few condo projects get off the ground, and some of the renters currently in the renter pool who are able purchase, do (most renters are not able to purchase at current market conditions), that will not decrease rental demand.

Look at the migration and growth rates and the projections.

OK, but this law has prevented more than just a few condo projects from getting off the ground. I would also like to revisit our old friend, supply and demand. If you have more housing that is for sale, supply increases, and therefore price decreases.

I should also point out that the lack of new condos for sale has also driven up the price on older condos that would not be fetching the price of where they are selling for right now.

Looking at migration rates, Denver is not alone in the growing cities category. Yes, Denver is growing, but a lot of cities are. Yet Denver leads the nation increasing rental rates. Look at Austin, it is one of the fastest growing cities in the nation, its growing a hell of a lot faster than Denver, and yet the cost of rentals are dramatically lower. Do you really think the rental rates in Denver should out pace Seattle, LA, New York, and many other traditionally expensive areas?

John –

While I agree with what you’re saying in principal, I think planners and advocates of density need to be really careful using language like you used above “If you have more housing that is for sale, supply increases, and therefore price decreases.”

In principal this is true, however in practice, the only time that a market would ever add so much inventory that established prices actually DROP would be after a real estate bubble bursts, like at the beginning of the great recession when we DID see this happen in cities like Las Vegas, Phoenix, and Miami. But this is not a desirable outcome, and no government official, property owner, or commercial developer would ever actually deliberately OVERBUILD the market. If a market overbuilds, it’s almost always a because of gigantic systemic miscalculation, not an attempt to drop housing prices. The appreciation that property owners see in their real estate investment really is good for all involved, and the economics of housing prices actually FALLING really aren’t good for anybody.

Opponents of growth know this full well, and in places like Boulder, the message is starting to get through that “this isn’t really about affordable housing.” This kind of thinking is dangerous, and urbanists do ourselves no favors when we claim that adding adding units in a controlled fashion might somehow cause rents to drop.

What should be said instead is that if construction can keep pace with demand, then perhaps we can prevent housing prices from rising artificially fast. Quick construction of new units might also help keep the units (or sub-markets like close in suburbs) that are currently affordable from appreciating too quickly, or slow the growth of high-end suburban units in the sprawl zone.

Denver’s growth is among the fastest in the country. We are an outlier. We’re not like a lot of other cities.

Speaking of for sale condo projects: consider cost of land, construction, insurance, financing, and the margins necessary for the project to “pencil out.” Then consider the “demand.” Meaning ready, willing, and able buyers at $400+/ft.

Denver’s rental growth rate of 10% YOY is outpacing almost every other city but to say our rents are higher than the cities you mention is false. Also, published numbers of median rents are known to be skewed and in some cases very wrong.

Hi John,

You’re absolutely right there are many variables and the one you brought up is probably the strongest, and I should have said “necessarily” instead of “exactly”. I also agree with you that the construction defects law is a decent sized reason as well, it’s prevented or slowed down condo development for over a decade now.

From the satellite image it looks like there are plenty of surface lots in Arapahoe Square and Uptown to be developed in the future.

Because developers don’t like low rent

Another question to ask is, “how many of the luxury apartment buildings that were constructed lately are going to be converted into for sale condos at some point down the road?”.

It seems like some developers have found a loophole around the construction defects law.

Yep, my understanding is that the wait is about seven years to convert apartments to condos.

I initially thought this would be the case. However, after touring a lot of these “luxury” rentals I am really unimpressed with the quality of finishes. I imagine they will need a significant investment before they could be sold for the $300-400 per/sq.ft prices high end condos are going for today. I’m also not convinced that buyers with the kind of money required to make a purchase of a $400k condo will be interested in living in a glorified dorm with 200+ units.

They might still have a 7 year period once the conversion takes place if they convert. IS that part of the law clear? Converting isn’t that easy and it impacts things like the financing the project has. Some projects would not be able to convert if they wanted to. Depends on how the deal is structured. Most of these buildings are also predominantly 1 bedroom, and smaller floorplans.

The real reason we’re seeing all apartments is because that is where the market demand is, and is projected to be in the future. Millennials (22-34) and other young urbanites do not have the wages, credit, and down payments to be purchasing downtown condos en masse. The last condo boom was fueled by cheap credit and bad loans. Sure, there’s some who do and would, but not enough in Denver to risk multiuple buildings 100+ units. Plus, what would those buildings cost if instead of a stick framed stucco, they now have to be concrete and brick? When you’re buying a condo you expect more and the everything is nicer.

The apartment boom has far greater reaching origins than defect liability. In the future, we’ll most likely continue to see large amounts of apartements being built. We do however need new condo buildings but its not like if there was no defect liability, these apartments would all be condos.

This discussion seems focused on the Millennial renters moving into Denver, as if they’re an established, static market. Eventually, many of them get married, have kids and want to buy a condo or townhouse — and very likely in an urban setting close to Downtown. At present, because of the Condo Defects Law, there’s nothing available.

This pro-consumer law, aimed at protecting buyers from bad builders, has had the unintended consequence of almost completely killing the condo/townhouse market. Greedy trial lawyers wrote the law, which rewards buyer “victims” with up to TREBLE DAMAGES — a ridiculously high incentive to sue — and allows an entire homeowners association to join a suit in a class action, if just TWO home buyers in the HOA have the same or similar construction defects. As a result, insurance on builders and construction companies has shot so high, they’ve left the market.

Governor Hickenlooper had a chance to lead the state out of this morass — with majorities in both houses favoring the badly needed fixes to the law — but he caved, when just one key Democrat blocked the bill in committee.

Anti-business do-gooders, pushing through their Law of Unintended Consequences, driving up the price of housing so high, it’s no longer “affordable” to middle class buyers. Denver already has very high, complicated zoning hurdles for builders, the result of NIMBY opposition to growth, going back more than half a century. Now, the long-term effect of the Defects Law is that home buying is simply out of reach for most Millennials, who will be tempted to leave Colorado, to more affordable states. If the law doesn’t get fixed soon, the housing market across the state will become like Boulder’s, where too much messing with the market has simply priced out the middle class.

I don’t happen to believe the condo defect law is having major implications on building in the Denver area. While the larger projects are currently rental units, there are a number of smaller condo/townhome developments being built. Think Factory Flats, Lohi Place, Berkeley Park, Glenarm Grove etc.

In terms of affordability of downtown, most of these millennials are moving to Denver from significantly higher priced coastal geographies and still see Denver as cheap vs. where they have been. I don’t see a real risk of them choosing to move to Houston, Kansas City or Memphis for cheaper housing.

Last, its only natural that downtown pricing pushes the middle class further and further into the suburbs as downtown matures. Look at other desirable cities in the U.S. In New York the middle class has moved to the outer boroughs, In Los Angeles the middle class has moved to the San Fernando Valley. San Francisco, Seattle, Portland, Austin all very expensive for individuals or families that want to live downtown. Its just a natural part of the process.

Scott – I totally agree with you about the migration patterns. We need to recognize that our “city” is actually a collection of cities with over 3 million people and an array of local governments. the City of Denver is the most important one, and the primary economic driver, but the housing market is much bigger than Denver’s 675,000 people. Fundamentally, I’m not sure it’s at all wrong that the oldest, most distinctive, most urban part of the metro area also happens to be among the most expensive parts of town. This just shows that people here finally value our historic core in a way that they haven’t done since the early 20th century. It’s a shock to established residents to be sure, but like you, I don’t find it that surprising or unusual. And it certainly bodes well for the kind of urban product developers will want to build in the decades ahead of us, even when building in the suburbs.

Scott, if the Condo Defects Law isn’t a major problem in the housing market, why was there a bi-partisan majority in both houses, ready to vote for it? Talk to any builder, if you don’t think it’s killed the condo/townhouse market?

I’m only saying a number of condo projects continue to get built regardless of the Condo Defects Law so some builders continue to find ways to make the economics and risks work.

Yes, at the extreme high end of the market. But if that is all that is being built, that does not represent a normal market.

Nash, I’m going to do my best to avoid a political argument here, but what in the world is so difficult about developers building structures properly in the first place? Why do we need to shelter developers, like the guy who built the Beauvellon without any drainage, ruining all the exterior stucco?

Are the residents, who were purportedly sold fully-functioning condominiums, supposed to be responsible for the developer’s shortcomings?

Going to arbitration first, conducted by a mutually agreed upon third party, while still providing an avenue for the homeowners to sue the developer if the results of the arbitration are unsatisfactory is not exactly “sheltering developers.” Granted, the city should be stepping up their inspections so that neither step becomes necessary, but having a “sue first” and “sue only” pathway is not in the best interests of everyone.