Situated across the street from the 38th and Blake commuter rail station, FoundryLine has broken ground bringing along a new tower crane. Previously mentioned as “The Foundry,” this new titled project features the same design and breakdown: a 17-story residential building with 348 apartment homes, 14,000 square feet of ground-floor retail, and parking for 282 automobiles and 207 bicycles.

Excavation and foundation work is currently taking place. With no underground levels, we should see this building go vertical relatively quickly. Here are a few photos from multiple perspectives around the project site.

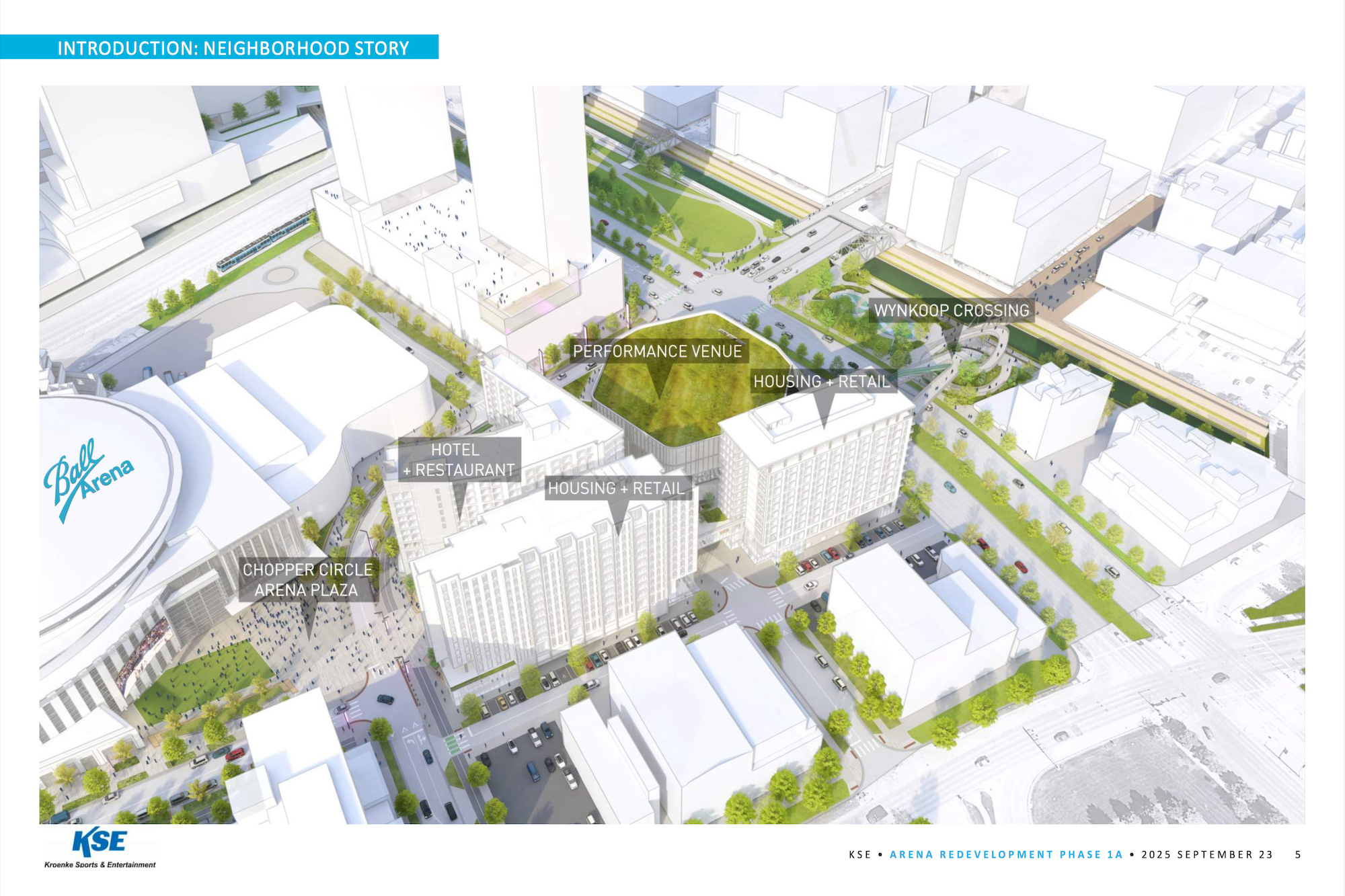

Below are two aerials showing the project site and a view from the east showing where FoundryLine will fit in the cluster of density around the 38th and Blake commuter rail station.

Here are a couple of rendering refreshers of the project. FoundryLine is developed by McWhinney, built by Hensel Phelps, and designed by Craine Architecture.

It’s great to see all the new density going up around River North!

A 1:1.25 parking:unit ratio literally across the street from a rail station still seems high to me. The bike to car parking ratio otoh sounds great, an excellent start. Maybe they can convert some more car parking to bike parking at a later date when the city finally fixes our zoning code.

@John R – This is being billed as, “luxury apartments” so I would expect most units to have cars even if the rail did go everywhere. I think it’s a bit of a shame that there doesn’t seem to be any retail though. There’s going to be so many new residents in this area soon and nowhere to go to in the immediate area.

There’s going to be 14,000 square feet of retail.

Hello Ryan, I could be mistaken, but I read Chris comment as retail (in the immediately surrounding area), which there currently seems a lack of. It will be Interesting to see which tenants see the early potential of establishing themselves in RiNo with the 14,000 square feet. Also Chris, regardless of immediate retail options, they can easily grab the rail right down to Union Station where there’s no shortage of options. I can’t imagine that being too far to go for proper shopping and dining. Cheers!

Even Union Station has had difficulty filling ground-floor retail in all its new buildings. There are so many spaces along the streets that have literally never had a tenant. Makes me think all the luxury buildings have priced out all but wealthiest of national brands.

Currently reserving judgment, because last year was, uh…a little weird! But I’ve grown a bit concerned about incentives for brick-and-mortar businesses around the city in buildings like this and others. Upstart food concepts are much more likely to set up shop in a “food court,” where foot traffic is all but guaranteed. Traditional retail is now more likely to seek out warehouse space rather than storefronts. At what point does someone go, “Maybe we should make these spaces more accessible to local entrepreneurs? To businesses that might take a few years to turn a profit, so that we can help build a viable commercial district in a decade’s time?”

Is there a good reason to leave a retail space empty rather than approach a young and ambitious restauranteur, an upstart clothing brand, an unpretentious neighborhood bar? Something to attract other businesses and build area demand.

It’s a real issue, but–long story short–the “forever vacant” new retail spaces are something that realy can’t be solved until either Federal changes in the financing laws/regulations regime, building owners being able to refinance their loans with much lower principal/rates, or a 2008-type crash causing these buildings to foreclose and be bought at discount prices.

It sucks, but that’s just the way these buildings/retail spaces are financed these days.

We’ve been in a rock-bottom interest rate environment for nearly fifteen years now. Is that *really* what’s causing an issue here? That ownership groups can’t refinance half a percent? Or have they been chasing pie-in-the-sky margins in a rapidly developing urban area for more than a decade and not recognizing commercial rates are due for correction?

My thought is they ALL need to treat ground-floor commercial space like a value-add for their residential tenants. The best way to maximize residential yields is to deliver immediate tangible value to the neighborhood. What does an extra $4K a month from your restaurant tenant matter when consumers are climbing over themselves to live in your residential space?

What happens is that (and this sounds ridiculous but it’s real) is that the financing is structured around projected rent. Now, that means you have to charge a certain minimum rent or the rate goes up next time you re-do the loans (remember, commercial is much shorter term than your common residential mortgage). That means, in many cases, as long as you are able to meet the payments, it is often better to refuse to budge below that projected rent, then to lower it so that it rents out, because if you do so, then the projected rent would be based off the actual rent, which would increase the rate at the next restructure.

As I said, the incentives in the NATIONAL financing systems are perverse. As long as the building owner can make the payment, it works for them. If a future recession really digs into the local market however…

For sure! There are a LOT of pads that need to be filled here and in Downtown, that’s for sure.

If there’s luxury apartments then there’sa market for someone to build a purpose-built garage. Forcing parking into every single building doesn’t make sense, let the market handle it.

In the other post it said the “Novel RiNo” is a 5 to 12 story building with 483 apartments, whereas this on is 17 stories, but only 348 apartments. How come the discrepancy? Does the Novel simply have a larger ground space? Smaller apartments? Other differences in density? Underground floors?

The parcel size for the two projects is vastly different which is the primary contributor to the difference. FoundryLine is a half-block development while Novel RiNo’s parcel is roughly four times larger.

Many such new buildings in Denver recall the drab exteriors of the 1930-1950s. They still resemble IBM punch cards in the sky. Nothing new here.