A large project is underway in Jefferson Park. After years of seeing a vacant lot, with an abandoned tower crane occupying a portion of it, 26th and Alcott has finally broken ground and is now under construction. When we announced this project back in 2018, plans called for 642 for-sale condos contained in a 15-story building taking up an entire city block. While the design of the building remains the same, the breakdown is a bit different. Plans now call for a mixed-use building split between 533 apartment homes and 93 apartment-style hotel rooms.

At the start of the year, two tall tower cranes were installed that are visible along the I-25 corridor due to the higher elevation of the project site. Present-day, most of the foundation and groundwork is complete, with the elevator cores going vertical. Here are a handful of ground-level photos from all sides of the project site.

Below are two more aerials of the project. It’s great to see how much of a gap this project will fill, better connecting Jefferson Park in an area full of more suburban-style development from the era’s past.

Let’s wrap up with three current renderings of 26th and Alcott. The design remains the same from 2018, with OZ Architecture still the architect of record. While the 15-story high-rise structure occupies most of the project site, the elevation also steps down to four stories towards the west end of the project. An internal parking podium is included in the project; however it is completely wrapped by the building and not visible along the street.

It’s great to see this full city block development finally underway after all these years!

| Project Description | Developer | Architect | Contractor |

|---|---|---|---|

| 15 Stories | 533 apt homes | 93 hotel rooms | 568 (v) parking |

Grand Peaks | OZ Architecture |

Weitz Construction |

Hi Ryan — Out of curiosity, is there any particular reason we’re still seeing some proposals start out with for-sale condo offerings that eventually convert to rental units? This seems to be a concerning trend.

Usually it boils down to how much risk the developer wants to take on. However, in this market, it does seem quite strange that we just cannot get large scale condo developments going (minus a single project at 18th + Glenarm).

I wonder when the adjacent hotels will be torn down? Whatever goes in there will have the best views of the city.

For the length of time that interest loan rates stay high for buyers, combined with high construction costs, compounded by a severe shortage of for sale units in this city….The lack of buyers with money are driving the market. Can’t find a house to buy, afford a down payment, or be afford to start a family AND purchase a home? That means zero purchasing leverage for a buyer. Developers: Rent for life, and look at all these amenities! You’re welcome! Why would developers “do us a favor” and build affordable for sale units when they can invest a similar amount (cheaper construction though!) with less risk, to build, hold, and sell as an asset at a massive profit? Why pass the equity on to condo/homebuyers when there are no real incentives to do so? I don’t blame them.

wooooow condos to apartments… what a let down

I can’t believe any contractor would “abandon” a tower crane.

I live a block away and while it’s possible there was stuff abandoned on the ground that I didn’t notice, I’m not sure what they’re talking about. There certainly wasn’t anything vertical on that lot.

I think I can see what looks like a green pile of dismantled tower crane sections in the Maxar photo in the post above. Is that the abandoned crane? If not, what is that pile of stuff?

That’s the crane. It wasn’t vertical, it was in pieces on the ground. Our original announcement post had photos of said crane as well.

https://difcdn.denverinfill.com/wp-content/uploads/2018/12/19011518/2018-12-23_26th-alcott_site-2.jpg

Will the hotel part of it occupy all of the 4-story section?

You will own nothing and you will like it.

THAT’S where I left my crane!

Some insight for those asking why condo projects often convert to apartments: financing and deal economics. In Colorado especially, it’s easier to raise debt/equity for both the construction and permanent (post-lease-up refinance) loans. Banks are inherently risk-averse and are still worried about remaining construction defect issues, even though things improved a few years ago with legislative reform. Banks also see the single-owner model (i.e. apartments) as less risky in general due to simplicity and predictability – the likelihood that a developer can either refinance the construction loan or find a single institutional buyer able to pay $1000+/sf for the project following apartment lease-up is perceived as more of a ‘sure thing’ than the possibility of finding ~300 individually qualified households who can afford the same pricing.

On a related note, you’ll notice that many of the “failed” condo projects in town are conceived by smaller (sometimes less experienced) local developers that have a great vision, but ultimately find it difficult to get projects out of the ground for the above-mentioned reasons (among others). These projects tend to be sold to a larger apartment developer (as was the case here) or redesigned into apartments by the original developers (see Formativ’s project on Blake in RiNo) once they determine that working on some sort of project is better than staying irrationally committed to the original vision and going out of business.

Not saying any of this is a “good” explanation, just sharing why it happens. We should celebrate whenever one of these condo projects does make it out of the ground (The Coloradan, 18th and Glenarm), as it likely represented a truly herculean effort and unwavering commitment to a specific vision by the development team involved.

Howdy, E.

Imagine you might have some reforms in mind you might be able to share with the group. After the construction defect deregulation, what hurdles remain? What argument might you make to those inclined to support reasonable consumer protections? Does the city or state need to get involved in backing these loans? And if so, what’s the bank even for at that point? If lending institutions don’t have the fortitude, should we all just start lobbying for publicly developed condo projects? Something like the Singapore model? Kind of at a loss at this point.

(Nice looking project, btw. Used to live a block from there myself. And yeah—the garbage heap that sat there seemed really careless and unnecessary.)

jmpmk2 – All outside of my expertise unfortunately. A condo developer/GC (both of whom risk being sued), their banks/lawyers, as well as consumer advocates, would all be better positioned to make recommendations. One issue I’m aware of is that HOA boards can still sue the developers and GCs with majority support from the residents. So that risk didn’t go away. Agree there are very complicated issues at play. Increasing the for-sale pipeline in Denver has been a dream of many for some time now – if it had straightforward solutions, we’d probably already have found them.

Because I am better versed in the real estate capital markets business, I can say this: low interest rates and strong investment demand for multi-family have created an environment where the single-buyer model is highly reliable and profitable for developers. Maybe one solution would be supporting individual consumers in a way that gave them an advantage over investment managers. Finding a way to encourage lower interest rates for primary mortgages (vs. investment loans) could be one way to tip the balance – if individual consumers are at an advantage and can therefore pay more on a per-unit basis than investors, the risk-reward calculus for developers would change…

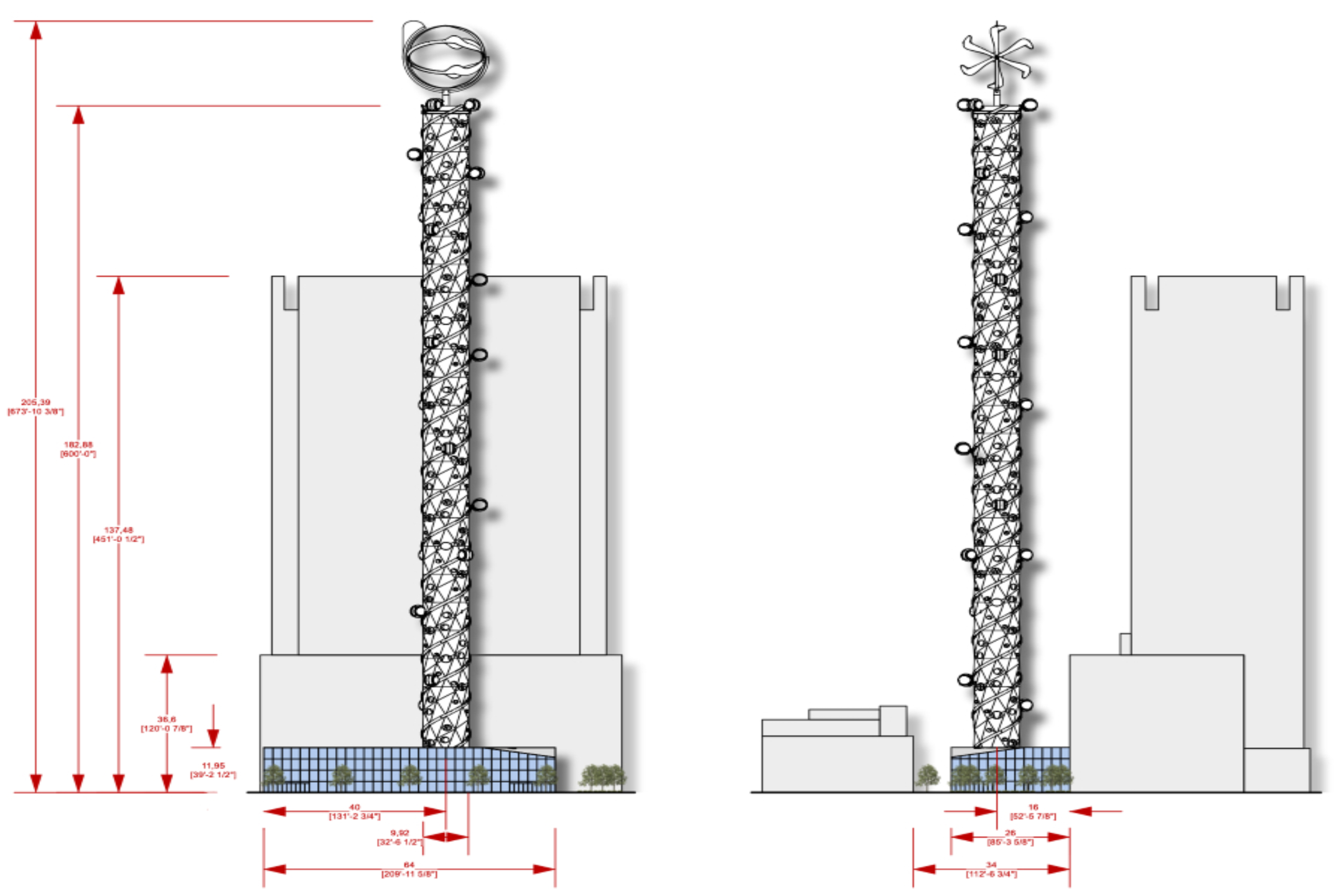

How long before the eyesore motels to the east are replaced? And this time, can it be a building that makes a statement and not like the mustard and brown 2785 project? How about our own Space Needle?

Very big letdown in that this went from a promising for-purchase condo development to yet another for-lease apartment project that seems to be the only thing Denver is building at this point. Would have been a great opportunity for the many looking to buy in or near downtown. I understand the reasons as to why it happened but still very unfortunate. It’s good that an eyesore of a prime lot gets to become something of use after years of neglect. But, seriously, Denver desperately needs for-purchase large-scale condo projects to happen and for housing inventory to beef up significantly.